Establishing the right asking price is critical to the home selling process.

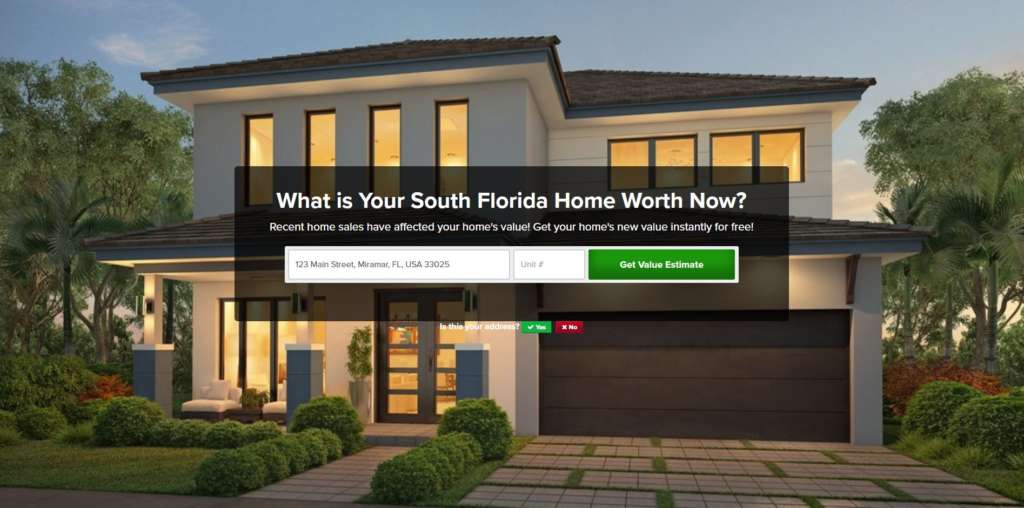

Click on the box below to get the Automated Valuation Model (AVM) estimates for your home. Keep in mind that this is only a starting point as estimates vary greatly across national AVMs. It is not meant to replace more in-depth property valuations like in-home inspections or Comparative Market Analysis (CMA) tools. Because they are automated, AVMs don’t take into account the human element of real estate. This may include neighborhood changes that can be intangible to home improvements that aren’t reflected in public records. If you want a more accurate assessment, fill out the form on our Comparative Market Analysis (CMA) page and one of our SKILLED agents will prepare a more accurate assessment for you.

An AVM is a computer-generated algorithm that uses historic, public sales data and trends to estimate a home's value.

While the Property Report is a great way to get an idea of what your home might be worth, it is meant as a starting point and does not replace an actual comparable market analysis from your real estate agent or a home appraisal. Obtaining a professional appraisal or requesting a Comparative Market Analysis from a real estate agent is recommended. For further information on your home’s current market value, connect with a real estate agent.

For the most accurate estimate, contact us to request a Comparable Market Analysis (CMA). This report is personally prepared to give you a clear understanding of competing properties, market trends, and recent sales in your area.

A CMA is a free report prepared personally by one of our agents that compares your home to similar properties in your neighborhood that are currently for sale or have recently been sold. By taking into account certain aspects of a home that may affect its value and marketability, including market conditions, location, and the home's amenities and overall condition, our agents are able to better assist you in determining the value of your home.

A Licensed Agent from Skilled Real Estate can provide you with a comparative market analysis (CMA). A CMA consolidates all the data from available comparables and gives you an estimate of what your home value should be.

An appraisal is typically required for a buyer to qualify for a mortgage. As a seller, there is some value in getting an appraisal because it can give you a firm idea of what your house is worth and provide assurance to a prospective buyer. However, since appraisals typically cost a few hundred dollars, most homeowners only pay for a professional appraisal if it is required for a refinance.

Yes, home valuation can change over time for a variety of reasons. The hope is that your home will appreciate, meaning it will gain market value. But there is no failsafe way to predict these changes.

Changes in the market itself are a major contributing factor to fluctuation in home value. As demand goes up, prices typically go up, and vice versa. Changes in the economy, job market, interest rates — these are things that influence home value and are well beyond your control. But there are some things you can do to help your home’s chances of appreciation over time, like making smart upgrades and strategic renovations.